Cost Segregation Saves Commercial Property Owners Millions

What Is Cost Segregation?

It's all about the time value of money. Currently, your property is set to depreciate in either 27.5 years for residential or 39 years for commercial. But did you know that you are allowed to accelerate depreciation on many of the components in your building like cabinetry, carpeting and lighting? Cost segregation is an IRS approved powerful tax strategy that allows you to reclassify numerous building assets into shorter 5,7, and 15-year class lives.

By making your deductions larger, your current taxable income is greatly reduced, which increases your cash flow. What you do with the money is up to you. Many of our clients use their tax savings to reinvest in their business, purchase additional property or even pay off their principal building payment.

How Does it Work?

- It all begins with a Free, No Obligation Analysis. You simply provide some basic information and we’ll prepare a customized analysis detailing your estimated benefit and our fee to prepare your study. If it’s not beneficial, we’ll let you know that too.

- We personally go to your property anywhere in the United States and perform a comprehensive site visit to document the property per IRS guidelines.

- At CSSI®, our experts then create an engineering-based cost segregation study by identifying and placing your buildings components in their proper, (and shorter) 5-, 7- and 15-year class lives in addition to the typical 27.5 or 39 year life. This proven strategy can reduce income taxes up to $75,000 for every $1,000,000 in building cost basis owned.

- Our report is the supporting document that allows your tax professional to take the missed tax benefit in the current tax year, without amending past returns. We specialize in partnering with your tax professional to get this done efficiently and accurately and have completed over 30,000 studies for clients in almost every industry, from office buildings, retail stores, warehouses, Airbnb’s, apartments, self-storage, and many, many more.

CSSI®, A Name You Can Trust

This is your money, we want to help you keep more of it. Since 2003, we've completed tens of thousands of studies in all 50 states for commercial properties of all kinds valued from $200,000 - $1.5 billion. Our highly experienced team of experts is focused specifically on preparing accurate and compliant engineer-based studies that maximize every benefit allowed per IRS regulations. Our focus is to provide an affordable, accurate engineering-based study that will maximize your tax savings and cash flow.

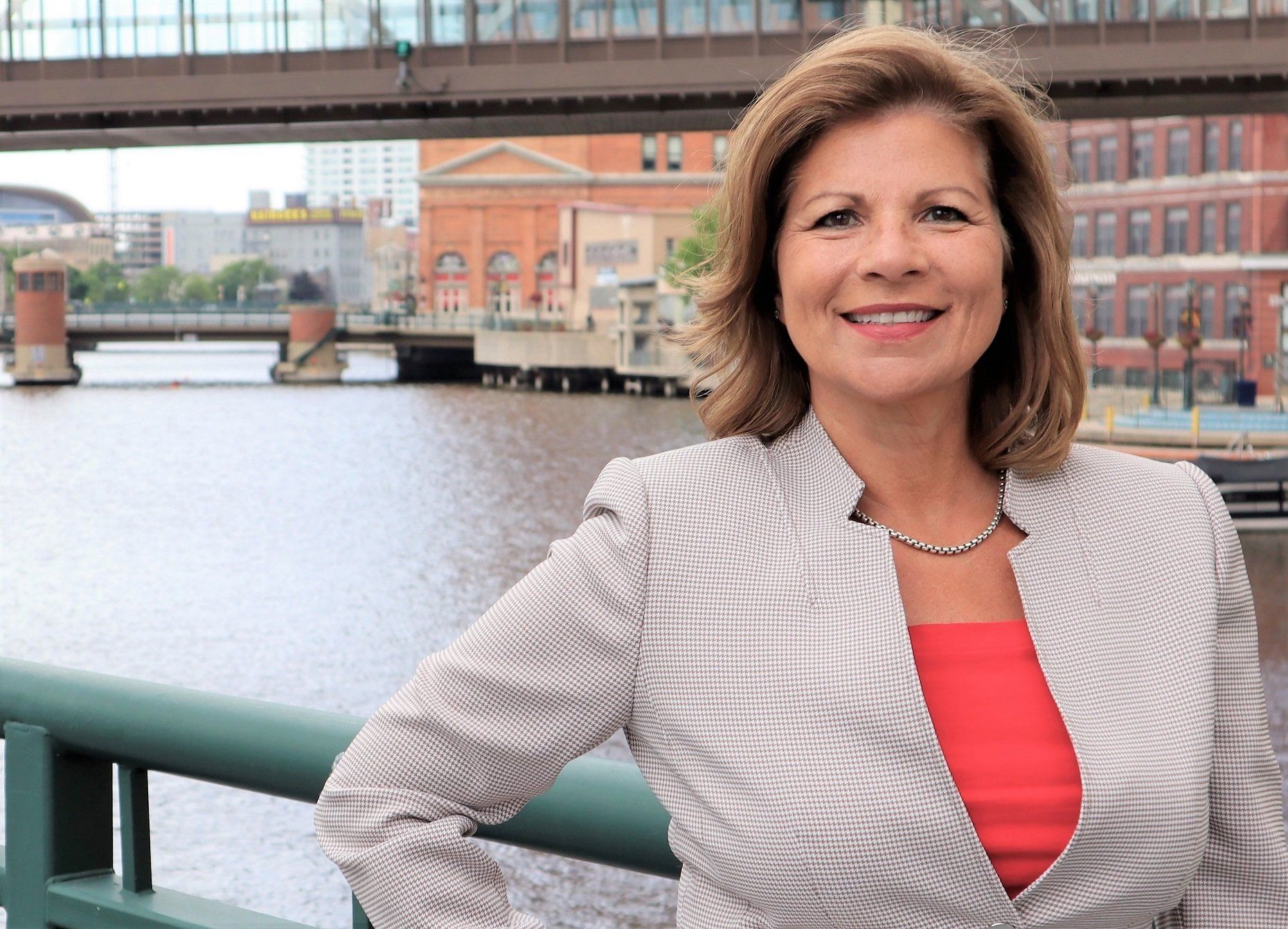

My name is Tami Simko and I have personally helped over 700 commercial property owners throughout the United States to realize tens of millions of dollars in extra cash flow since 2008. I’m dedicated to working closely with you and your tax advisor to ensure the best possible results that are both compliant and accurate.

If you are a tax professional, I can offer you free CPE courses and show you how to grow your practice, increase customer loyalty, and keep clients compliant with cost segregation and repair regulation studies.

Feel free to contact me at

866-799-2774. I’m here to help.

Discover Your Potential Savings

Get your No Obligation, FREE estimate by filling out the form below.

SIMPLIFIED

We work with you and your tax professional to streamline the process and ensure the best results.

EXPERIENCED

We've performed over 30,000 studies nationowide, putting Billions back in the hands of our clients.

COMPLIANT

Our engineering-based study method adheres to all IRS tax code guidelines and recommendations, and we guarantee our results.

CSSI® is the premier company for engineering-based cost segregation studies in America. For more information, or to schedule a consultation and get a free estimate, call us at 866-799-2774.